This way, after paying rent, you’ll remain with plenty of cash to use towards other expenses. For instance, if you make $3,000 in a month, the cost of your apartment should ideally be $1,000. As a rule of thumb, the rent amount should not exceed a third of your monthly income. Now, before renting an apartment, it’s important to make sure that you can afford the rent. In California, for instance, the cost of a one-bedroom apartment could fall anywhere between $2500 and $4500(or more). Some of the cities known for high rental costs include New York, California, Massachusetts, and New Jersey. It doesn’t cater to additional fees such as utilities.

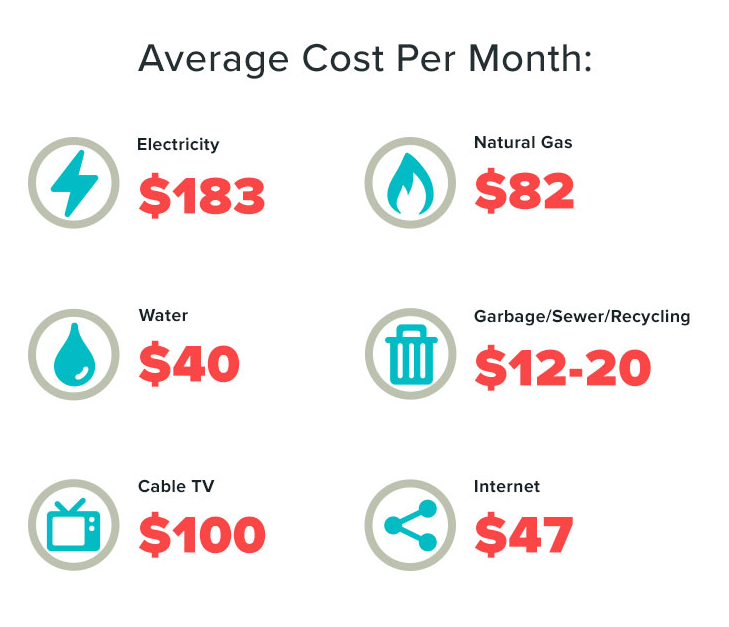

Base rent simply refers to the monthly rental cost. The amount of base rent you pay per month mainly depends on the neighborhood and the size of the house you’ll rent out. So, what costs come along with a rental apartment? Here’s a list to get you started. This way, you can avoid financial strains in the future and protect your credit. All you have to do is learn about the costs in advance and establish whether or not you can meet them. That being said, renting out a property shouldn’t scare the wits out of you. Among many include utilities like water, gas, and electricity which you ought to budget for beforehand. While paying rent will certainly be your biggest responsibility as a tenant, there’s a myriad of other bills which you’ll be responsible for, as well. That notion couldn’t be further from the truth! A common one is that renting an apartment is just about staying on top of the monthly rent. There are many misconceptions among first-time renters.

0 kommentar(er)

0 kommentar(er)